9 Key differences between ERP and accounting systems

What are you really getting when you upgrade to ERP?Although there may be some confusion around the topic, accounting and ERP systems are completely different pieces of technology. Accounting systems offer simple, plug-and-play, off-the-shelf functionality for small businesses. ERP systems—also known as Business Management Systems—provide a complete suite of powerful functions to help larger, more complex organisations manage every process and department from a single source of truth.

What is Accounting Software?

An accounting system serves as the financial backbone of a small business. It can track financial transactions and generate essential reports. Specifically, the focus is on accounting functions such as bookkeeping, accounts payable, and accounts receivable.

Accounting systems are pre-configured under the assumption that one size of software will fit all businesses. They are designed to address the specific needs of accounting departments.

What is ERP Software?

Enterprise Resource Planning (ERP) systems are larger, more complex pieces of software compared to an accounting system. ERPs integrate and manage core business capabilities across the organisation in one connected platform including: finance, payroll, sales and customers, inventory and supply chain, projects, production, and field services. Unlike accounting systems, ERP systems become a single source of all your company’s data, capturing financial and non-financial (time, stock, weight, distance travelled, etc.) data.

ERP systems are better suited to larger organisations with detailed revenue streams, multiple entities and hierarchies, stringent compliance and reporting requirements, and more departments, products, customers, projects, and bigger teams. These systems aim to streamline and connect multiple departments across an organisation by sharing data and automating processes, while maintaining the segregation of responsibilities. This is so your team can work with the same real-time data, which leads to better decisions and more efficient operations.

ERP systems do much more in scope than off-the-shelf accounting systems – even in finance, accounting and tax.

9 Key Differences Between ERP and Accounting Software

There are many standard differences between ERP and accounting systems. You may see more or fewer differences when comparing specific systems.

1. Functionality

Accounting Systems:

- Only have functionality options centred around finance and accounting. The finance functionality is solid but has little customisation. Any other information must be manually duplicated into and out of this system.

- Are limited to the general ledger, accounts payable, accounts receivable, and set reports. Some accounting systems can manage simple payroll. Any additional reports must be built manually or created in spreadsheets.

ERP Systems:

- Have a much broader focus on functionality and can support many more departments across the organisation. Because all these departments are connected in one system, duplicate manual data is reduced or eliminated.

- Are usually modular, able to combine a range of functions in one connected software ecosystem. These modules cover each organisational department, for example, finance, payroll, inventory management, customer relationship management, procurement, project management, etc.

Calculating the ROI of ERP Software eBook

Download now2. Integration

Accounting Systems:

- Typically operate as independent systems. They can only perform their set functionality with little scope for integration with other systems and databases.

- Create silos of disconnected data – usually across different databases or spreadsheets. Data silos require manual duplication to be maintained and naturally create inconsistencies across different departments.

- Have limited options for integration, usually determined on a system-to-system basis. Integrating your accounting system with a common industry application may be impossible.

ERP Systems:

- Are configurable to the unique requirements of your business

- Are built to allow integration. This is due to their modular design and the expectation that complex organisations use additional best-of-breed satellite products to manage various specialised functions.

- Become a single source of truth for your organisation’s data. Integration breaks down data silos, ensuring that all departments are connected with the same data at all times.

- Use Application Programming Interfaces (API) for secure application integration. APIs are functional and flexible and can be configured to a range of different databases and systems.

3. Automation

Accounting Systems:

- Are limited to basic accounting tasks and smaller work volumes, so they have limited ability to deal with larger automation processes.

- Have steps and functionality to enhance efficiency for the finance team but lack the comprehensive functionality to enable broader workflow automation.

ERP Systems:

- Leverage the live data flowing through integrations to automate processes across departments and improve the entire organisation’s efficiency.

- Use automation to handle larger volumes of transactions, optimise your processes, and save valuable time for your team.

4. Scalability

Accounting Systems:

- Operate to a fixed size and capacity. They only ever have the functionality that comes with them out of the box.

- Have little flexibility for additional users over the lifetime of the system. Some accounting systems are limited to 2 or fewer users. Some have transactional limits.

- Can only handle smaller, if any, bulk processes. As your transaction, customer, or team volume grows, an accounting system may struggle to keep pace.

ERP Systems:

- Are highly customisable to meet your changing requirements. When workflows and processes change, the system can be reconfigured to support that change and improve efficiency.

- Can be built with additional modules, integration, licences, users, and automation. These extra functionalities are designed to support your changing complexities at scale in both your current and future states.

- SaaS ERP systems are regularly updated to include new technology, such as AI.

5. Reporting and Analytics

Accounting Systems:

- Are equipped with a basic set of financial reports and some standard analytics. These reports struggle to tell you anything about the wider business.

- Produce static reports that may not always be up to date with the latest data. Building reports manually also relies on slower end-of-period reconciliation processes and collating data disconnected in silos. This may mean that you are creating monthly reports that are already a month or more out of date, limiting the full-picture visibility of your business.

ERP Systems:

- Have advanced reporting and analytics capabilities. Integration and automation mean that these reports are always up to date with the latest real-time data from across the organisation.

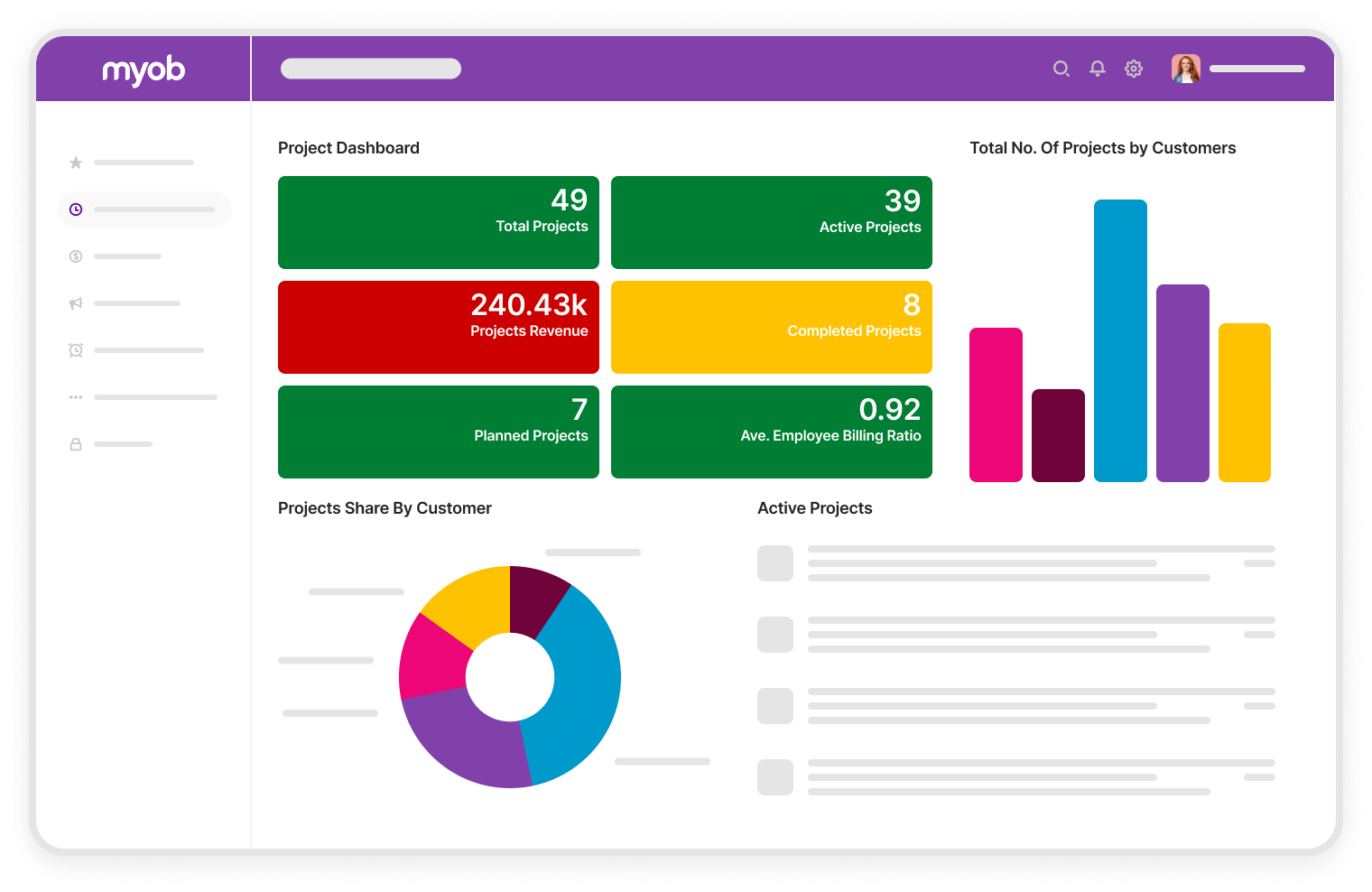

- Can produce dashboards and business intelligence metrics and track key real-time performance indicators (KPIs). Access to the most accurate data at every stage is critical to making informed business decisions at the team, management, and board level.

6. Users

Accounting Systems:

- They are limited to a fixed number of users based on the specific system. Usually, only your finance and accounts team require access to your accounting system.

- Do not separate accessibility based on the user login. If you can access the system, then you can access everything in the system – regardless of whether it is appropriate for your role or not.

ERP Systems:

- Are usually licence-based. Each user requires a licence to sign into the system. This means that when your team grows larger, the only bottleneck to your accessibility is the number of licenced users. Especially in Software as a Service (SaaS) systems, licences are simple to provision and deploy for your new team members.

- Support defined access for every user across your organisation. Leading ERP systems have detailed licensing structures to better manage accessibility and roles across your system. This incorporates the separation of responsibilities inherent in larger, more complex organisations, as well as functionality for approval pathways within the core system.

7. Implementation

Accounting Systems:

- Are fast and easy to implement and start using. There is not much to do for an implementation, hence names like “plug and play” and “off-the-shelf”. Simply purchase the software and immediately access the standard functionality.

- Cannot be configured with the depth and breadth needed to meet complex requirements or facilitate integrations or automation. This is due to their more limited scope and functionality.

ERP Systems:

- Require a dedicated implementation project and specialised implementation consultants. Implementation projects can take 3-6 months or more before you are ready to go live with a new ERP system.

Rely on an experienced, qualified software partner for customisation and to manage the risks of the implementation. This extracts more power out of the available functionality and delivers a bespoke system that better meets your unique needs.

8. Compliance

Accounting Systems:

- Are designed to meet basic regulatory compliance for financial reporting.

- May not support industry-specific compliance needs.

ERP Systems:

- Support broader and more complex audit and governance requirements.

- Often include features to meet specific industry regulations and standards.

9. Cost

Accounting Systems:

- Generally have lower costs associated with the software. This is in part due to the specialised, focused functionality. The system can only do so much, and you are charged to reflect this.

- Require consideration of the impact of efficiency on your overall costs. Your team may be costing your organisation more than the savings from the software, wasting time with manual, inefficient processes because they are not supported by the right software system.

ERP Systems:

- Have higher costs, both initially and ongoing. Certain systems may also require specific hardware investment, such as on-premise servers, which can add to the cost. User licences are usually more expensive compared to accounting systems, but this is due to the wider array of functionality available.

- Require a dedicated implementation project from a software expert. This increases the initial investment in an ERP software as this consulting and implementation process is billed separately to your ongoing software licences.

When does a business need ERP instead of accounting software?

Once businesses start to employ more than 20 people or have a turnover of approximately $8 million per annum, they tend to require more complicated accounting and financial functionality. This cannot be handled by an off-the-shelf accounting package – you need an ERP system.

There are many signs that you are beginning to outgrow your accounting software and need an ERP system:

- Manual processes that you had previously relied on are now slowing you down and causing errors,

- Your growing inventory of products is becoming difficult to manage,

- Projects are becoming increasingly complex, and you lack the insights to verify their profitability or efficiency,

- Declining service levels due to systems and processes not designed to support your scaling customer base,

- A growing number of employees, including more complex payroll and onboarding requirements,

- Struggling to operate across multiple locations, offices, warehouses, or countries,

- You use an array of disconnected third-party products to manage each department, with no single source of truth for company data.

How do I choose an ERP system?

It is best to seek the advice of the experts when deciding if a business management system will be a good fit for your organisation. Trust the advice of an experienced implementation partner. They will assess the complexities of your organisation and match them with the capabilities of the system.

Because of the complexity involved with implementing and using a business management system in the long term, you should remember that the ERP selection process involves three components:

- The software itself,

- The implementation process, including training,

- The ongoing support and business process improvement

Buying an ERP system is like buying a car—there is an enormous array to choose from. The best approach is to define your requirements and then look for systems that meet those requirements. Buyers often get overwhelmed by enthusiastic salespeople telling them about all the bells and whistles, but it is best to ignore this tactic and focus on your core functionality requirements. Stick to well-known and localised brands and make sure the implementing partner can support you for many years to come.

Examples of ERP systems:

Making your way through the ERP Selection process

Download nowMYOB Acumatica – cloud solution for complex organisations

MYOB Acumatica (formerly MYOB Advanced) is a powerful business management platform, designed to encompass a broader range of functionality beyond accounting. It can integrate various business processes across the 7 key organisational capabilities:

- Finance – bank reconciliations, deferrals, tax, and accounting

- People – payroll, workforce management, and leave management

- Supply Chain – inventory management and demand planning

- Sales and Customers – customer relationship management (CRM) functionality

- Production – discrete manufacturing, bills of materials (BoM), and material requirements planning (MRP)

- Projects – job management, quoting, and billing

- Field Services – track and manage your mobile workforce

MYOB Acumatica is a cloud-based business management system localised for larger, more complex organisations in Australia and New Zealand. It is based on the Acumatica Cloud ERP, the fastest growing cloud ERP system in the world. MYOB Acumatica has the range of powerful functionality to improve efficiency in your organisation through the use of integrations and automation.

MYOB Acumatica Information Pack eBook

Download nowHow do I choose an accounting system?

A small business using an ERP is like owning a Ferrari to drive to the shops – fun and powerful, but unnecessary and expensive. ERP systems are more powerful and comprehensive compared to accounting systems, but they are built for larger, more complex organisations. For many small businesses, it is still appropriate to use simple accounting software for your financial processes.

Tips to choose a small business accounting system:

- Assess your cloud vs on-premise requirements – cloud-based systems are typically more modern, flexible, and accessible and avoid the costs of on-premise server maintenance,

- Read reviews and get recommendations from your network – it is likely that other businesses have faced challenges or seen success with specific systems,

- Take advantage of free trials – many small business systems have free trial periods for you to test a system and make sure it can support your requirements,

- Research vendors and their support – whether it be a system issue, or a busy end of financial year a vendor’s support can make or break your software experience; do not underestimate the impact of good support.

An ERP is required when your business has evolved to be larger and more complex. You should meet the requirements for an ERP and then take advantage of its scalability. Rushing into implementing an ERP system when it is not suitable can cause more harm to your organisation in the long run.

Examples of accounting systems:

- Xero

- Reckon

- MYOB Business Essentials

- MYOB Business AccountRight Plus

- Quickbooks

Trust the right implementation partner

MYOB Acumatica is a complex, sophisticated business management platform. It requires an in-depth solution design and configuration to meet your requirements and to add the most value to your organisation. While an MYOB Acumatica implementation may seem like a daunting project, you can engage an expert implementation partner to guide you to a successful outcome.

Kilimanjaro Consulting is the largest, most experienced implementer of MYOB Acumatica across Australia and New Zealand. Our experienced team takes a low-risk approach to implementing MYOB Acumatica, ensuring that you get it right the first time, and positioning your organisation for future growth. You may not have done this before, but we have.

As part of our structured MYOB Acumatica implementation methodology, we believe that the successful journey is focused on identifying four distinct states:

- Current State: Identifying and understanding current workflows within the organisation.

- Future State: Exploring the benefits of the new software and the changes required to improve your efficiency.

- User Acceptance Testing and Training: The period of familiarisation with the new system, testing the customisations, and moving towards the position of improved efficiency.

- Go-Live: The combination of the previous states, delivering MYOB Acumatica to match your business requirements.

7 Keys to choosing the right implementation partner Brochure

Download nowTake the next steps

If you are a small business struggling to manage your growing team and different departments, then it may be time to consider a business management system.

Talk to our team for a free discovery session and to understand if an ERP system like MYOB Acumatica (formerly MYOB Advanced) is a good fit for your organisation. Email sales@kilimanjaro-consulting.com or call 1300 857 464 (AU) or 0800 436 774 (NZ).