Cash Flow Management: How To Free Up Your Cash Flow

Streamline your Accounts and Improve Cash Flow to get ahead of your competitionEditor’s Note: This article was originally posted on April 5, 2016. It has since been reviewed and updated to provide the most relevant and accurate information.

Every successful business owner knows that cash flow is one of the most critical factors for the success of their business.

Just as fuel keeps a car engine running, cash flow keeps your business moving forward. Employee wages, stock, rent, and other operating expenses drain your business’s ‘fuel tank’. Unless you’re replenishing that fuel regularly, your business will likely splutter to a stop by the side of the road.

The concept is simple, but many businesses face ‘refuel challenges. Each time a business has an outstanding account receivable, they provide credit free of charge to their debtors. And the longer these receivables remain outstanding, the higher the likelihood they turn into bad debts and subsequent write-offs.

Typical factors that limit cash flow

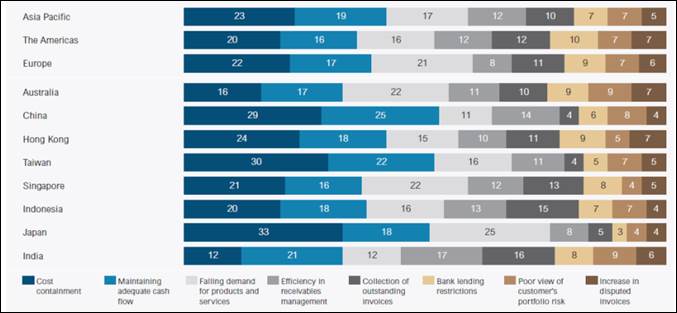

It’s not rocket science: the timely receipt of payment and efficient collection of past due invoices mean quick turnover of working capital invested in the same receivables. The profitability of businesses is hindered by an inability to contain costs, maintain adequate cash flow, and inefficiencies in accounts receivable. In particular:

- Average payment terms: Business-to-business (B2B) customers in Asia-Pacific are given an average of 33 days from the invoice date to pay for goods and services purchased on credit.

- Overdue B2B invoices: 9 in 10 organisations will experience late payments, and about 1 in 10 invoices will remain unpaid after 90 days. Approximately one-quarter of the value of outstanding Accounts Receivables are overdue by more than one month.

- Average payment delay: Late invoices are typically settled 25-28 days after the due date. Interestingly setting short payment terms for B2B customers does not improve their payment behaviour.

Although these factors limit the potential of any business whose working capital is not invested in growing the business further, new technologies coupled with financial reforms set by central banks can facilitate faster adoption of online and mobile B2B payment solutions that businesses can leverage.

There are three quick, low-cost, and effective ways to improve the receivables management process, avoid cash flow issues and streamline collections:

1. Electronic and automated invoice processes can result in significant savings compared to traditional paper-based processing. The digitisation and interoperability of invoices help speed up the distribution of invoices and their payments through an integrated “Pay Now” button linked to an online payments page. By adding integrated “Pay Now” buttons to invoices, automated platforms can facilitate immediate invoice payment, shortening the number of Days of Sales Outstanding (DSO) by up to 20%. Faster payments improve cash flow, and the integrated payment options simplify reconciliation inside your back-office accounting solution.

2. Accounts Receivable (AR) automation enables Finance Departments to get broader visibility of the AR process and ensures tighter control over the money the business owes. Best practice solutions enable operators to set invoice distribution and reminder/notification rules, take ad hoc credit card and bank account payments, set up direct debits for a recurring invoice, and track/report on customer disputes and notes.

3. Automating Collections can assist businesses in streamlining internal processes and collecting scheduled and late payments, improving customer and staff satisfaction and visibility of customer activities, thereby reducing customer risk.

But what can I do to collect payments faster?

Add-Ons such as ezyCollect are all-in-one accounts receivable platforms designed to help growing businesses recover cash faster, without the hassle. These tools are designed to streamline and simplify the entire invoice-to-payment process, improving productivity and customer relationships.

Top ezyCollect features for MYOB Advanced and MYOB Exo users

ezyCollect has a range of other features, in addition to improving cash flow:

- A payment portal lets every customer self-serve to view, download and pay all invoices online.

- Credit card payments are automatically allocated to your debtor’s ledger

- B2B Pay Later lets customers buy now and pay back in easy instalments

- Choose which debtor contacts receive different types of automated communications

- Personalise and customise reminders, so they always look and sound like your business

- Exclude the customers you do not want to chase

- You can be up and running in a few days. ezyCollect works closely with Kilimanjaro Consulting to seamlessly integrate with your MYOB Enterprise software.

To learn more about ezyCollect, download the brochure from the panel to your right.

ezyCollect 5 things you should be doing right now to reduce outstanding accounts receivable eBook

Download nowFree Webinar | How to improve cashflow and Accounts Receivable efficiency

Managing cashflow should be a top priority for any thriving business. Cashflow relies on getting paid on time and in full. Spending valuable time chasing overdue payments, fretting over client reliability, and posting and reconciling payments hinders potential growth.

Watch our webinar recording to discover how integrating innovative accounts receivable solutions can relieve your cashflow headache.

Contact our team at any time for methods and strategies to optimise your cash flow, as well as various solutions that can assist your organisation in becoming more efficient. Send an email to sales@kilimanjaro-consulting.com or call 1300 857 464 (AU) or 0800 436 774 (NZ).