Corporate Cards in MYOB Acumatica

MYOB Acumatica Tips and Tricks #8As of MYOB Acumatica version 2020.3, the use of corporate credit cards is now supported through the Expense Claim and Expense Receipt forms. This helps employees and accounts to categorise and track expenses. For example, an employee can buy something to charge to a project and pay for it with a corporate card. This transaction can be tracked and accounted for within MYOB Acumatica (formerly MYOB Advanced). However, employees can still have out-of-pocket expenses that are reimbursed through the standard process.

The new corporate card functionality provides the following advantages:

- Administrative users can manage corporate cards.

- Corporate cards support foreign currencies.

- Expense receipts in a foreign currency can be paid with a corporate card.

- A single expense claim can be created for all corporate card expenses, if they have the same card currency.

- Bank transaction matching and reconciliation process supports corporate card statements so that card statement records can be matched to expense receipts.

Initialising Expense Claims and Receipts

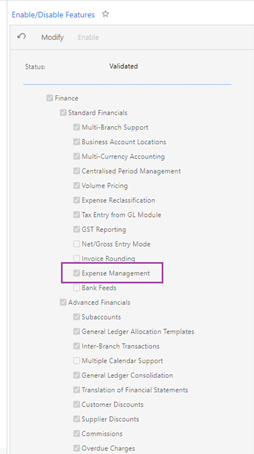

To start using the functionality of expense claims and expense receipts, which includes the corporate card functionality an administrative user enables the Expense Management feature. This can be done on the Enable/Disable Features (CS100000) form.

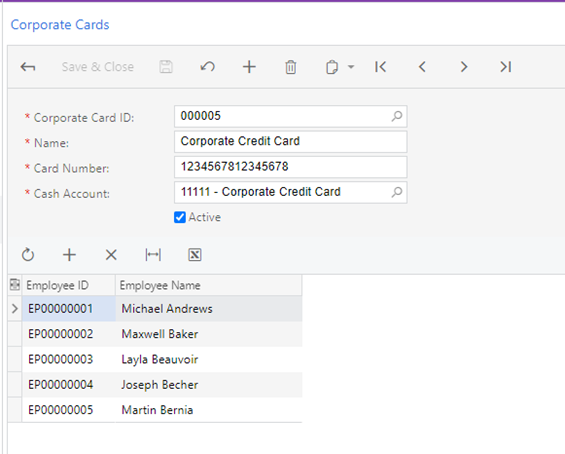

The Corporate credit cards themselves can be configured on the Corporate Cards (CA202500) form. The card number is used for matching transactions to a bank statement. Multiple employees can use a single corporate card; these employees are listed in the table on the form.

To enable corporate cards on the Corporate Cards form, General Ledger accounts, cash accounts, payment methods, and employees must all be configured as described below.

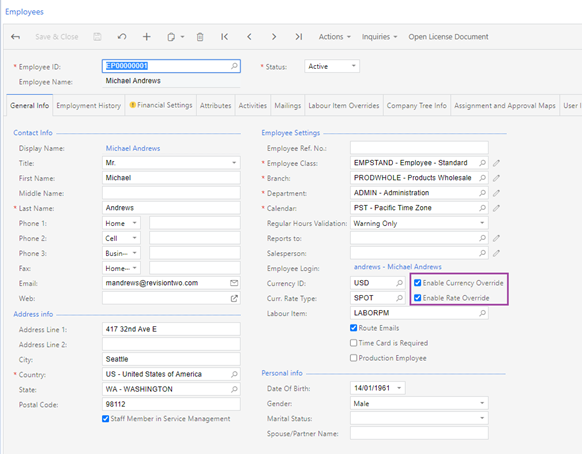

** Tip: If the card currency differs from the currency of an employee who uses the corporate card, for this employee, the Enable Currency Override and Enable Rate Override check boxes must be selected on the General Info tab (Employee Settings section) of the Employees (EP203000) form. The Currency ID box, where the employee currency is specified, can also be found in this section of the form.

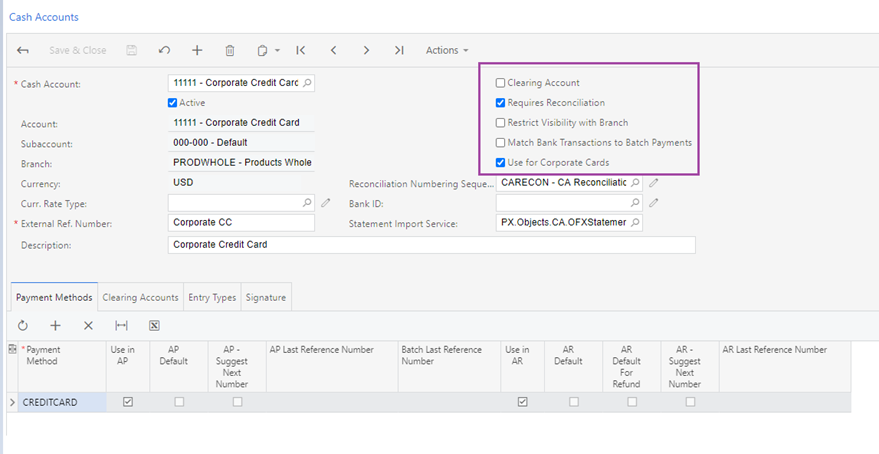

The cash account that is used for corporate cards should be configured as follows:

- A separate GL account should be configured for each bank and currency.

- Each GL account has a separate cash account with the following settings specified on the Cash Accounts (CA202000) form:

- The Clearing Account check box is cleared.

- The Restrict Visibility with Branch check box is cleared.

- The Use for Corporate Cards check box is selected.

- Only one payment method can be associated with the cash account.

- Optionally, the Requires Reconciliation check box is selected; if it is, a numbering sequence must be specified in the Reconciliation Numbering Sequence box. The predefined CARECON numbering sequence can be selected.

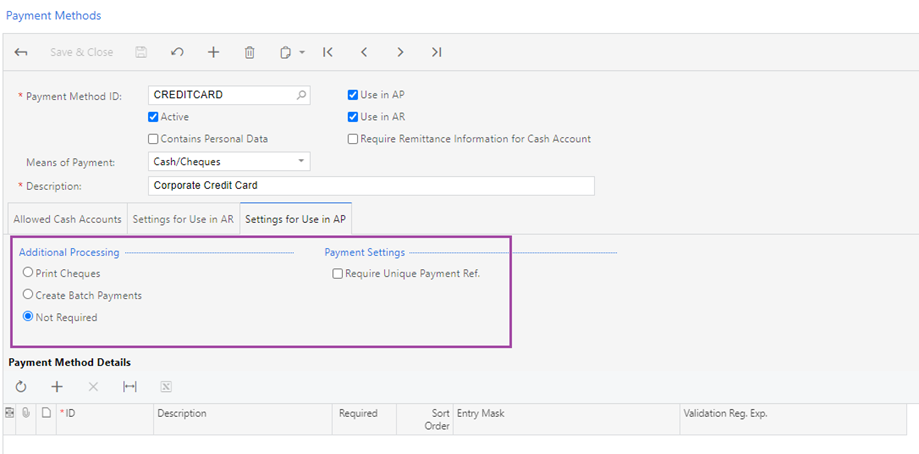

Although the cash account that is used for a corporate card must have only one associated payment method, this payment method can be selected for multiple cash accounts. If a payment method is selected for a cash account that is used for a corporate card, in the Summary area of the Payment Methods (CA204000) form, the Use in AP (Accounts Payable) check box is selected. Also, on the Settings for Use in AP tab of the form, this payment method should have the following settings:

- Not Required (Additional Processing section): Selected

- Require Unique Payment Ref. (Payment Settings section): Cleared

Paying Expense Receipts with Corporate Cards

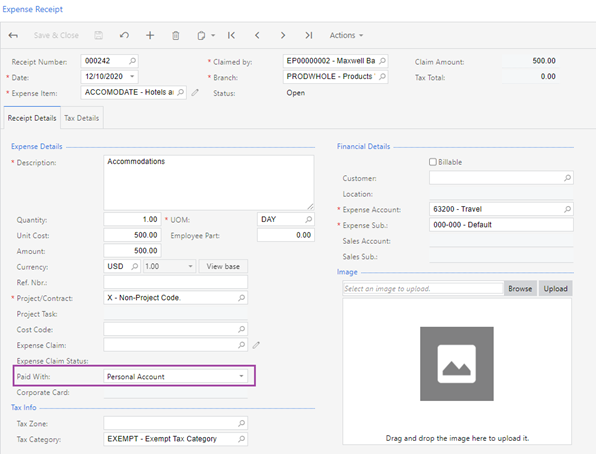

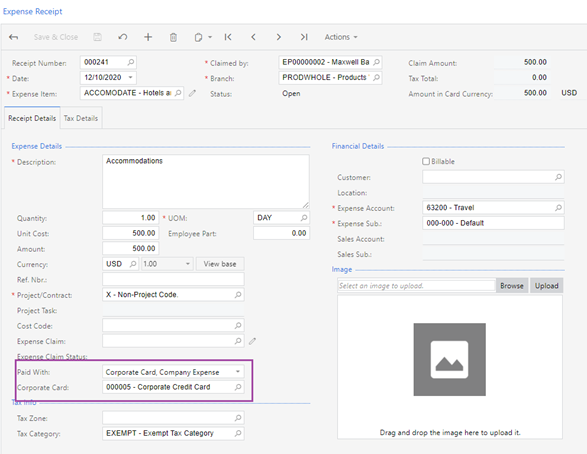

On the Expense Receipt (EP301020) form, in the Paid With box (in the Expense Details section of the Receipt Details tab), a user can select how the expense receipt has been paid. The following options are available:

- Personal Account: The company’s expenses that the employee paid with his or her own funds and the company will need to reimburse to the employee. This is the default option if the employee has no active corporate card assigned.

- Corporate Card, Company Expense: The company’s expenses that are paid with a corporate card. This is the default option if the employee has an active corporate card assigned.

- Corporate Card, Personal Expense: The employee’s personal expenses that are paid with a corporate card.

In the Corporate Card box, the user selects from their available corporate cards. By default, the card used in the employee’s most recent expense receipt is selected, as determined by the receipt’s creation date. If the most recent card is unavailable, the employee’s first active card (sorted alphabetically) will be chosen.

** Tip: The box to select the corporate card is unavailable on the form if Personal Account was selected in the Paid With box.

Corporate card expenses cannot be split between the employee and the company account. That is, on the Expense Receipt form, in the Expense Details section of the Receipt Details tab, the Employee Part of an expense receipt paid with a corporate card must be zero.

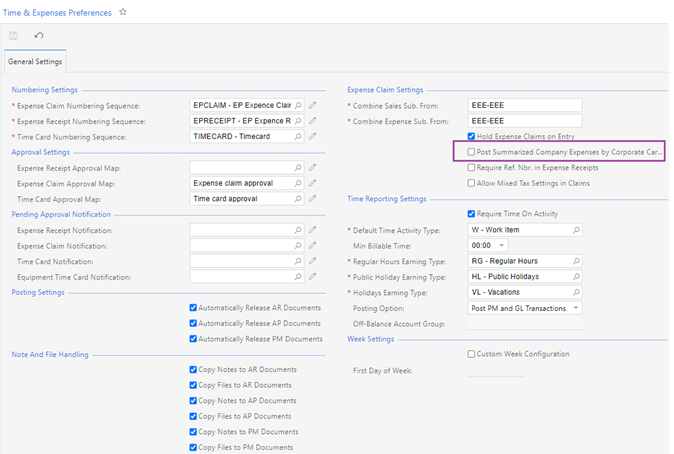

If the ‘Require Ref. Nbr. in Expense Receipts’ check box is selected (located on the General Settings tab of the Time and Expenses Preferences (EP101000) form) then the Ref. Nbr. box must be filled in with the reference number that matches the number of the original receipt.

Processing Expense Claims for Expense Receipts Paid with Corporate Cards

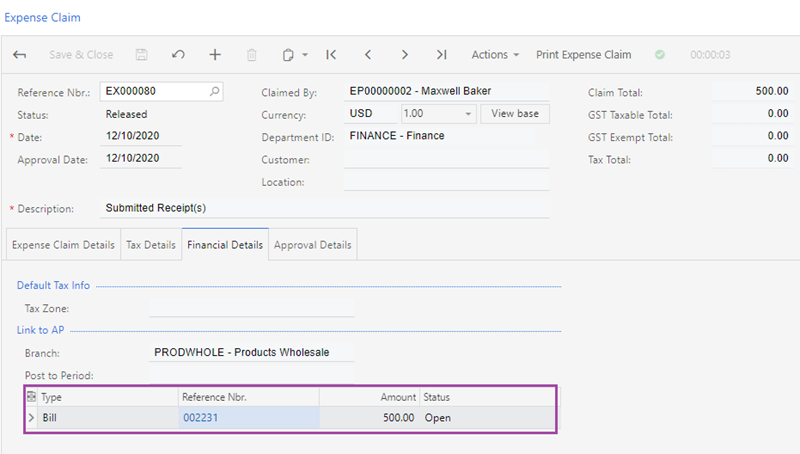

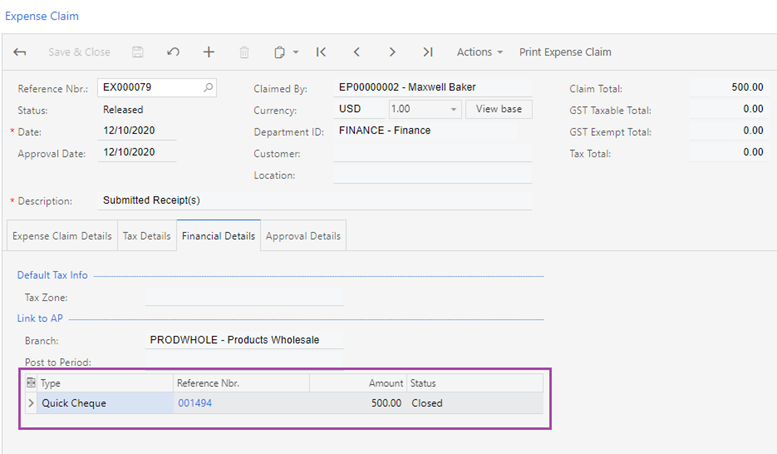

On the Expense Claim (EP301000) form, an expense claim can contain all the employee’s expense receipts paid with corporate cards as long as they have the same card currency. Each expense claim line refers to an expense receipt. On release of an expense claim, the system creates documents for the expense claim lines, depending on the value in the Paid With column:

- Personal Account: A single AP bill is created on the Bills and Adjustments (AP301000) form for all the expense claim lines with positive amounts and a single AP debit adjustment is created on the same form for all the expense claim lines with negative amounts.

- Corporate Card, Company Expense: An AP quick cheque is created on the Quick Cheque (AP304000) form for each expense claim line; if the Post Summarised Corporate Card Company Expenses check box is cleared on the General Settings tab of the Time and Expenses Preferences (EP101000) form.

** Tip: However, if the Post Summarised Corporate Card Company Expenses check box in selected, the system creates a separate AP quick cheque for each group of the expense claim lines with the same date, corporate card, and reference number. On release of this AP quick cheque, the system credits the card liability account and debits the expense account of the expense item specified in the expense receipt.

- Corporate Card, Personal Expense: A single AP debit adjustment is created on the Bills and Adjustments form for all the expense claim lines. On release of this AP debit adjustment, the system credits the card liability account and debits the employee’s AP account.

The new addition of Corporate credit card functionality to MYOB Acumatica, allows the simple and efficient reconciliation of expenses.

Interested in other ways to optimise MYOB Acumatica?

Check out our handy MYOB Acumatica Tips and Tricks blogs here:

- Generating On-Demand Statements in MYOB Acumatica

- The New User Interface – MYOB Acumatica

- Row-Level Security in MYOB Acumatica

- Generic Inquiries in MYOB Acumatica

- Fixed Assets in MYOB Acumatica

- Business Events in MYOB Acumatica

- Restricted use of Control Accounts in MYOB Acumatica

- Corporate Cards in MYOB Acumatica

- Matrix Items in MYOB Acumatica

- Restricted Visibility of Customer and Supplier Records

- Important features of reporting dashboards

- The Global Search Function in MYOB Acumatica

- Learn to Streamline your Intercompany Sales

- Simplify Your Cross-Company Sales

- Adding one-off public holidays to MYOB Acumatica Payroll

- Deferral Schedules in MYOB Acumatica

- Keyboard shortcuts to improve efficiency in MYOB Acumatica

- 3 Steps to Archive Documents in MYOB Acumatica

- How to streamline EOFY reconciliations in MYOB Acumatica

- Quality of Life Tips to Speed Up Month-End Processes

MYOB Acumatica Information Pack eBook

Download nowWe hope these tips and tricks were helpful to you! If you have any questions about Corporate Cards in MYOB Acumatica, our friendly team is here to help. Call us on 1300 857 464 (AU) or 0800 436 774 (NZ), or send us an email.

Alternatively, for a comprehensive overview of all of our best MYOB Acumatica ‘hacks’ in one place, you can download our PDF from the panel on the right – The Ultimate Compilations of Tips and Tricks!