Deferral Schedules in MYOB Acumatica

MYOB Acumatica Tips and Tricks #16The Deferrals module within MYOB Acumatica Business (formerly MYOB Advanced) is an effective tool to save time and maintain accuracy. Deferral schedules automate the recognition of your revenue and expenses in the correct accounting period(s). The system creates a deferral schedule at the time of sales invoice/memo or supplier bill/adjustment entry. Users must select a pre-configured deferral code in the invoice or bill.

The Deferrals module replaces manual calculation and reconciliation that is often completed in a spreadsheet. This manual process is both inefficient and prone to errors. Integrated with the general ledger, this module ensures that journal postings occur automatically for each periodic recognition.

What is a Deferral in Accounting?

In accounting, a deferral refers to adjusting entries in the general ledger to delay the recognition of revenue or expenses until a later accounting period or periods. Defer revenue recognition to a future period(s) when receiving payment from a customer before providing your goods or services. For example, an annual subscription payment received by a software company. Defer the recognition of an expense when you have paid for a product or service and the delivery is on a future date. For example, paying a rental expense to the landlord.

A deferral schedule is a handy automation to defer the recognition of revenue or expense until a later period, to ensure revenue matching, or to amortise revenue or expense over a period of time.

Creating a deferral schedule in MYOB Acumatica

Deferrals can be viewed from the Deferrals module, located in the menu on the left-hand side of MYOB Acumatica. Clicking on the Deferral Schedules menu item displays all current deferral schedules.

The role of deferral codes

Deferral schedules can be easily and repeatably created with Deferral Codes. When creating a deferral code, you can modify several different variables:

- Recognition Method – how will the revenue or expense item be recognized over time(e.g., evenly by period, pro rata by a number of days, or on payment)?

- Recognition percentage

- Occurrences – how many occurrences in the deferral schedule,

- Deferral Account and Sub Account

- Every X Period(s)

- Document Date Selection – is the deferral recognised at the start of a period, the end of a period, or at a fixed date within the period?

Creating deferral schedules within a transaction

Deferral schedules can be created from within a transaction on the Invoice and Memo or Bills and Adjustment screen. To create a deferral schedule, you must specify a deferral code by clicking into the Deferral Code field and selecting from a list of pre-configured codes.

It is critical to select the deferral code at the time of entering the invoice or bill. If this is omitted and the invoice or bill is released, you are unable to add a deferral code, and you must then create the deferral schedule manually.

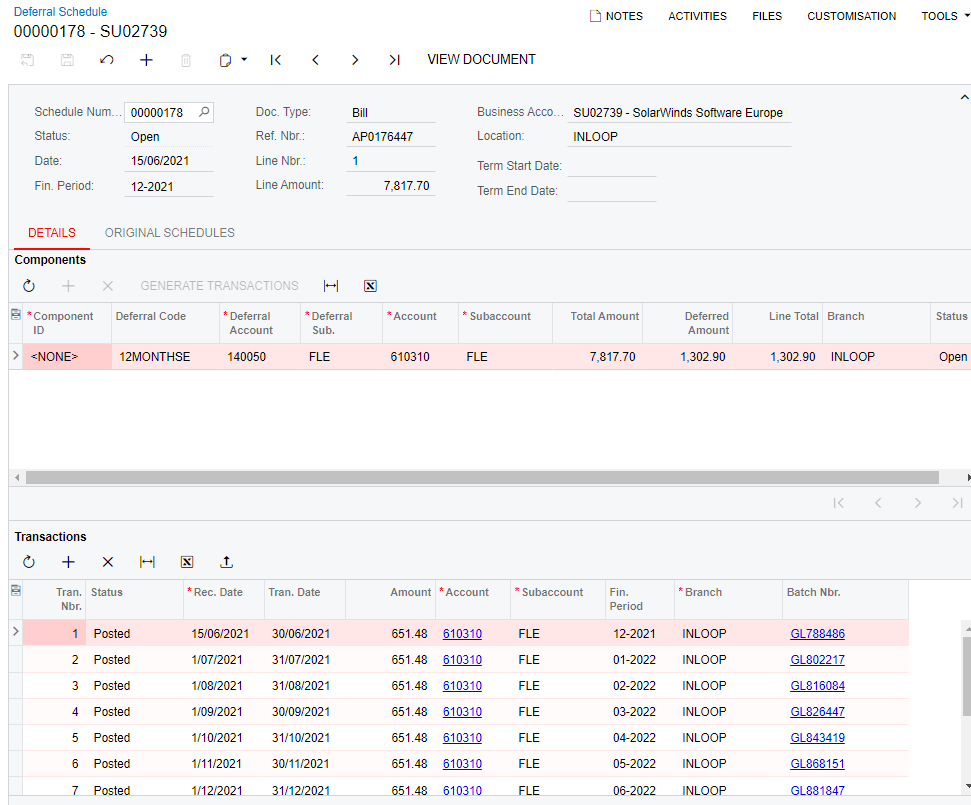

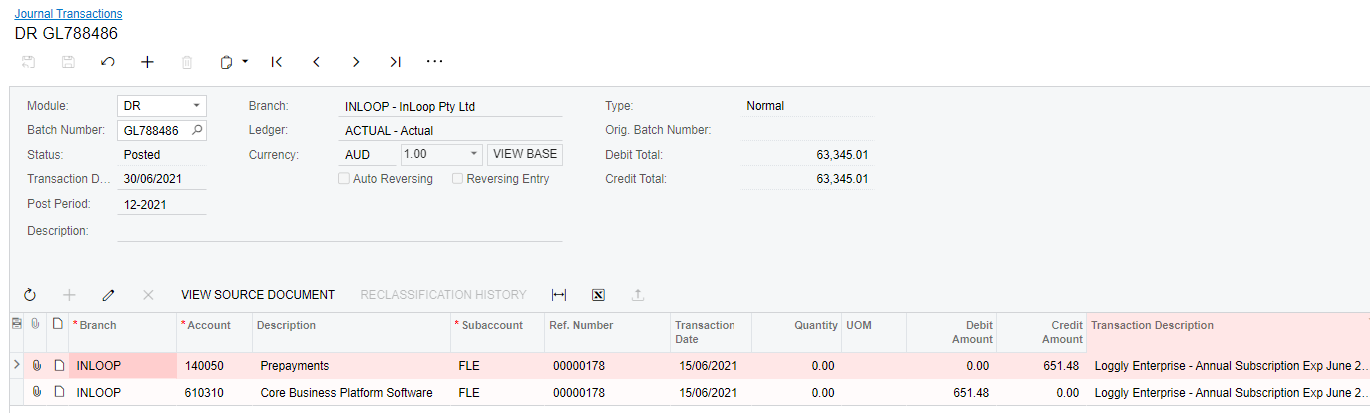

Upon releasing the sales invoice/memo or supplier bill/adjustment, the system automatically creates and builds the deferral schedule based on the selected deferral code as well as posting a General Ledger journal to the unearned revenue or prepaid expense account, instead of an income or expense account. The deferral schedule can be viewed from inside the transaction screen by clicking on the View Deferrals button.

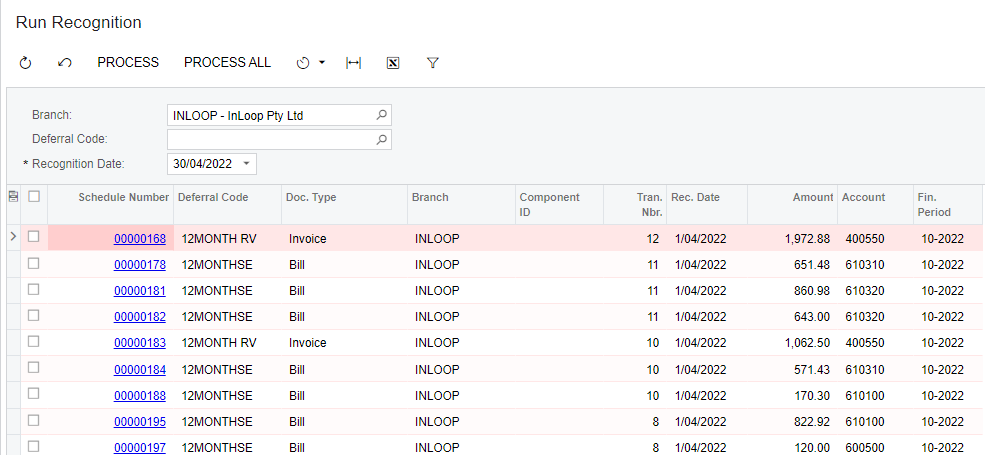

To run a deferral recognition from the Deferrals module you must select the Run Recognition screen from inside the Processes banner. This is typically a monthly routine as part of your month-end reporting process. You can select one, multiple, or all the deferrals by clicking the menu boxes. When processed, the system creates a General Ledger journal based on the value and conditions specified in the deferral schedule, reducing the balance of the unearned revenue or prepaid expense account and recognising the periodic value of revenue or expense in the correct accounting period.

Manually accounting for deferrals can become an inaccurate or overlooked process. Accurately managing your deferrals helps to paint the clearest picture of your organisation’s financial health. Make sure you are taking advantage of this amazing tool in MYOB Acumatica.

MYOB Acumatica Information Pack eBook

Download nowInterested in other ways to optimise MYOB Acumatica?

Check out our handy MYOB Acumatica Tips and Tricks blogs here:

- Generating On-Demand Statements in MYOB Acumatica

- The New User Interface – MYOB Acumatica

- Row-Level Security in MYOB Acumatica

- Generic Inquiries in MYOB Acumatica

- Fixed Assets in MYOB Acumatica

- Business Events in MYOB Acumatica

- Restricted use of Control Accounts in MYOB Acumatica

- Corporate Cards in MYOB Acumatica

- Matrix Items in MYOB Acumatica

- Restricted Visibility of Customer and Supplier Records

- Important features of reporting dashboards

- The Global Search Function in MYOB Acumatica

- Learn to Streamline your Intercompany Sales

- Simplify Your Cross-Company Sales

- Adding one-off public holidays to MYOB Acumatica Payroll

- Deferral Schedules in MYOB Acumatica

- Keyboard shortcuts to improve efficiency in MYOB Acumatica

- 3 Steps to Archive Documents in MYOB Acumatica

- How to streamline EOFY reconciliations in MYOB Acumatica

MYOB Acumatica Ultimate Compilation of Tips and Tricks eBook

Download nowIf you would like to know more about the benefits of MYOB Acumatica Business, please contact our team at sales@kilimanjaro-consulting.com or call us at 1300 857 464 (AU) or 0800 436 774 (NZ)