How to streamline EOFY reconciliations in MYOB Acumatica

MYOB Acumatica Tips and Tricks #19The end of the financial year (EOFY) can be challenging for businesses. Finance teams face pressure to close accounts and ensure accuracy for each transaction and amount. Ensuring periods are closed correctly throughout the year is the key to streamlining your end-of-finance reconciliations. MYOB Acumatica offers powerful tools to help manage this task effectively, and the Post Transactions Screen is a key feature that can make a significant difference.

The General Ledger at the end of the financial year

When closing periods for month-end or year-end, it is important to check that all transactions have been posted into the General Ledger for the period. The General Ledger is the single source of truth for all your revenue, expenses, and other financial transactions. It should be balanced and reconciled every month so that you can accurately track income and expenditure and build reports.

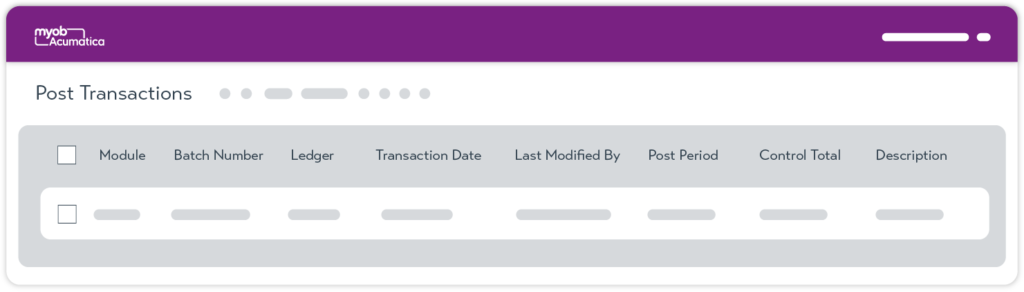

How to use the Post Transaction screen

If a transaction is posted to the General Ledger but could not be completed, its status will become ‘Unposted’ and be visible on the Post Transactions screen. Find this screen by navigating to Finance > Processes > Post Transaction Screen.

From the Post Transaction Screen, you can process each transaction that has been released but not posted to the General Ledger. These transactions can be processed individually or in bulk. Take advantage of automation within MYOB Acumatica to ensure these transactions are posted automatically before the month’s end. You can even set up a dashboard to check that this screen has no entries awaiting posting. Use a widget to count the number of transactions that have Unposted Status.

Why do you need the Post Transaction screen?

The reasons why transactions might not be able to be completed include:

- A transaction timing out from a sub-ledger,

- A reversing journal to an inactive period.

MYOB Advanced is now known as MYOB Acumatica

In July 2024, MYOB changed the name of the MYOB Advanced platform to MYOB Acumatica. This was to bring greater transparency to the alignment between the two companies that have been partners since 2014. The Acumatica Cloud Business Management Platform is the world’s fastest-growing cloud ERP system. It is developed by the Acumatica company in Seattle, USA. MYOB Acumatica is based on the Acumatica platform and has the same features and functionality. MYOB Acumatica is localised to the Australian and New Zealand markets, with local tax and compliance requirements.

Streamline your EOFY process.

The EOFY should be seen as a trigger for business and strategic decisions. Explore the 10 simple things you can do in your business and head into the next financial year ahead of the pack.

Ensure you have everything you need to prepare for the EOFY, including specialised Training Courses, helpful content and our valuable checklists!

Interested in other ways to optimise MYOB Acumatica?

Check out our handy MYOB Acumatica Tips and Tricks blogs here:

- Generating On-Demand Statements in MYOB Acumatica

- The New User Interface – MYOB Acumatica

- Row-Level Security in MYOB Acumatica

- Generic Inquiries in MYOB Acumatica

- Fixed Assets in MYOB Acumatica

- Business Events in MYOB Acumatica

- Restricted use of Control Accounts in MYOB Acumatica

- Corporate Cards in MYOB Acumatica

- Matrix Items in MYOB Acumatica

- Restricted Visibility of Customer and Supplier Records

- Important features of reporting dashboards

- The Global Search Function in MYOB Acumatica

- Learn to Streamline your Intercompany Sales

- Simplify Your Cross-Company Sales

- Adding one-off public holidays to MYOB Acumatica Payroll

- Deferral Schedules in MYOB Acumatica

- Keyboard shortcuts to improve efficiency in MYOB Acumatica

- 3 Steps to Archive Documents in MYOB Acumatica

- How to streamline EOFY reconciliations in MYOB Acumatica

- Quality of Life Tips to Speed Up Month-End Processes

If you would like to know more about the benefits of MYOB Acumatica, please contact our team at sales@kilimanjaro-consulting.com or call us at 1300 857 464 (AU) or 0800 436 774 (NZ)